The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

![The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240302/16/original_8b336136-2ca8-4137-aca7-10401bd9d5db.png)

Some Highlights

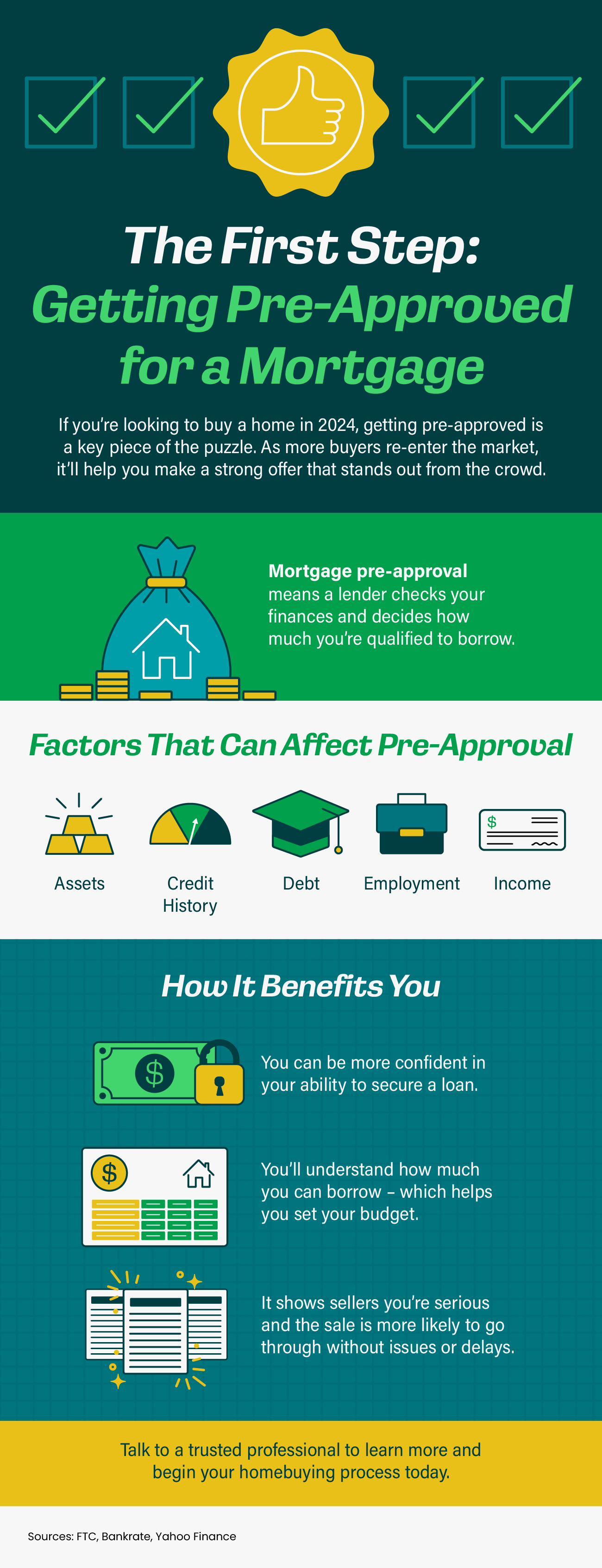

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

Recent Posts

This May Be the Best Time To Buy a Brand-New Home

Why More Homeowners Are Giving Up Their Low Mortgage Rate

The 3 Housing Market Questions Coming Up at Every Gathering This Season

How To Find the Best Deal Possible on a Home Right Now

Why So Many People Are Thankful They Bought a Home This Year

Why Buying a Home Still Pays Off in the Long Run

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

Most Experts Are Not Worried About a Recession

The Top 2 Things Homeowners Need To Know Before Selling

The Housing Market Is Turning a Corner Going into 2026